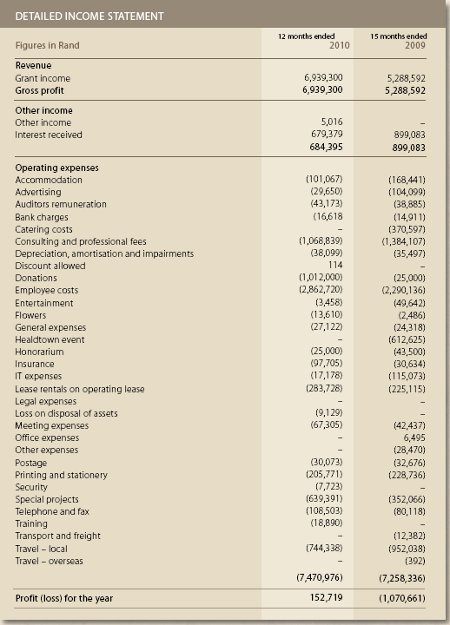

FINANCIAL STATEMENTS

Report of the Independent Auditors

We have audited the accompanying financial statements of the Historic Schools Restoration Project (Association

Incorporated under Section 21), which comprise the directors’ report, the balance sheet as at 31 March 2010, the income

statement, the statement of changes in equity and cash flow statement for the 12 months then ended, a summary of

significant accounting policies and other explanatory notes, as set out on pages 5 to 16 of the comprehensive financial

statements.

Directors’ Responsibility for the Financial Statements

The company’s directors are responsible for the preparation and fair presentation of these financial statements in

accordance with South African Statements of Generally Accepted Accounting Practice, and in the manner required by

the Companies Act of South Africa, 1973. This responsibility includes: designing, implementing and maintaining internal

control relevant to the preparation and fair presentation of financial statements that are free from material misstatement,

whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates

that are reasonable in the circumstances.

Auditors’ Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in

accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements

and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material

misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the financial statements. The procedures selected depend on the auditors’ judgement, including the assessment of the

risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments,

the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements

in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of

accounting policies used and the reasonableness of accounting estimates made by the directors, as well as evaluating the

overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinion.

Opinion

In our opinion, the financial statements present fairly, in all material respects, the financial position of the company as of

31 March 2010 and of its financial performance and its cash flows for the 12 months then ended in accordance with South

African Statements of Generally Accepted Accounting Practice, and in the manner required by the Companies Act of South

Africa, 1973.

Gobodo Incorporated

Registered Auditors

19 June 2010

Directors’ Responsibilities and Approval

The directors are required by the Companies Act of South Africa, 1973, to maintain adequate accounting records and are

responsible for the content and integrity of the financial statements and related financial information included in this

report. It is their responsibility to ensure that the financial statements fairly present the state of affairs of the company as at

the end of the financial 12 months and the results of its operations and cash flows for the period then ended, in conformity

with South African Statements of Generally Accepted Accounting Practice. The external auditors are engaged to express

an independent opinion on the financial statements.

The financial statements are prepared in accordance with South African Statements of Generally Accepted Accounting

Practice and are based upon appropriate accounting policies consistently applied and supported by reasonable and

prudent judgments and estimates.

The directors acknowledge that they are ultimately responsible for the system of internal financial control established by

the company and place considerable importance on maintaining a strong control environment. To enable the directors

to meet these responsibilities, the Board sets standards for internal control aimed at reducing the risk of error or loss in a

cost-effective manner. The standards include the proper delegation of responsibilities within a clearly defined framework,

effective accounting procedures and adequate segregation of duties to ensure an acceptable level of risk. These controls

are monitored throughout the company and all employees are required to maintain the highest ethical standards in

ensuring the company’s business is conducted in a manner that in all reasonable circumstances is above reproach. The

focus of risk management in the company is on identifying, assessing, managing and monitoring all known forms of risk

across the company. While operating risk cannot be fully eliminated, the company endeavours to minimise it by ensuring

that appropriate infrastructure, controls, systems and ethical behaviour are applied and managed within predetermined

procedures and constraints.

The directors are of the opinion, based on the information and explanations given by management, that the system

of internal control provides reasonable assurance that the financial records may be relied on for the preparation of the

financial statements. However, any system of internal financial control can provide only reasonable, and not absolute,

assurance against material misstatement or loss. The directors have reviewed the company’s cash flow forecast for the year

to 31 March 2011 and, in the light of this review and the current financial position, they are satisfied that the company has

or has access to adequate resources to continue in operational existence for the foreseeable future.

The external auditors are responsible for independently reviewing and reporting on the company’s financial

statements. The financial statements have been examined by the company’s external auditors and their report is

presented on page 28.

The financial statements, which have been prepared on the going concern basis, were approved by the Board on 19

June 2010 and were signed on its behalf by:

Historic Schools Restoration Project (Association Incorporated under Section 21) Reg. No. 2007/018649/08

Financial Statements for the 12 months ended 31 March 2010

|